how to avoid estate tax in california

See whether you qualify for an exception. Even if youre not in California there are still capital gains taxes depending on how your property was classified.

The Property Tax Inheritance Exclusion

With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax.

/images/2021/08/10/happy-woman-doing-taxes.jpg)

. Although there is no California inheritance tax there could be certain situations where an individual would rather reject an inheritance. A trustor the person who turns over the assets a trustee the person who manages the assets and a beneficiary the person who will inherit the assets. The California legislature has yet to pass the rules to interpret the exact implantation of Prop.

Fortunately there is also an exemption built into the various tax laws known as the capital gains real estate tax exemption. That is not true in. This goes up to 1206 million in 2022.

There are ways individuals can protect their assets by avoiding probate so that they can pass the maximum amount possible down to their heirs. There are several ways you can avoid capital gains tax for houses in California. Ownership and occupancy of custom built home.

Live in the house for at least two years. 13 Rules on Inheritance. The gift tax exemption threshold is 15000 in 2021.

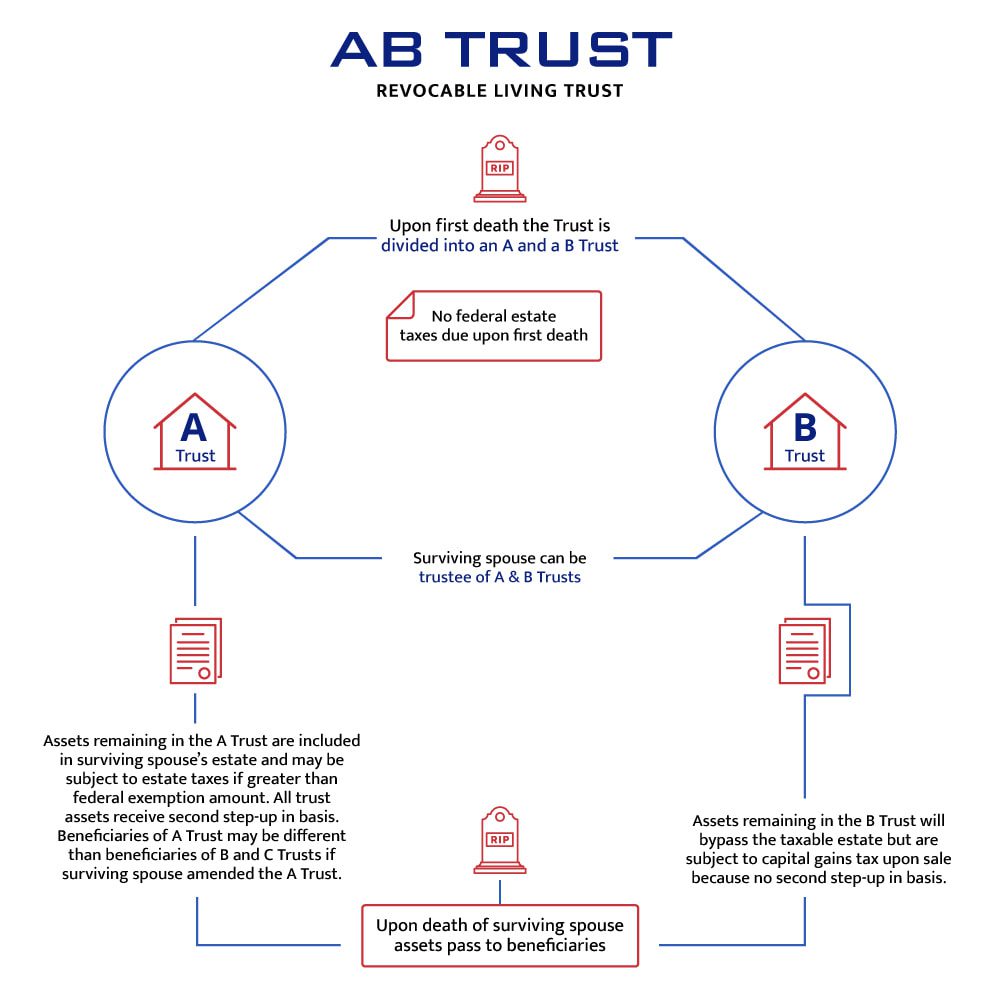

This tax has full portability for married couples meaning if the right legal steps are taken a married couple can avoid paying an estate tax on up to 2406 million after both have died. The California Estate Tax. Here are some ways to avoid probate in California Estate.

An irrevocable trust can be a handy way to avoid estate taxes if your estate is large enough to be potentially liable for them at both the state and federal levels. Birth marriage raising family. The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary.

These factors look to the State in which the following occurred. Resident state income tax returns filed. If you want to reject or disclaim an inheritance it can be done but it takes a little more than simply telling the executor you do not want the property.

Individuals looking to avoid probate can create a living trust under California law on any asset they own. To do so an. There are 3 requirements imposed.

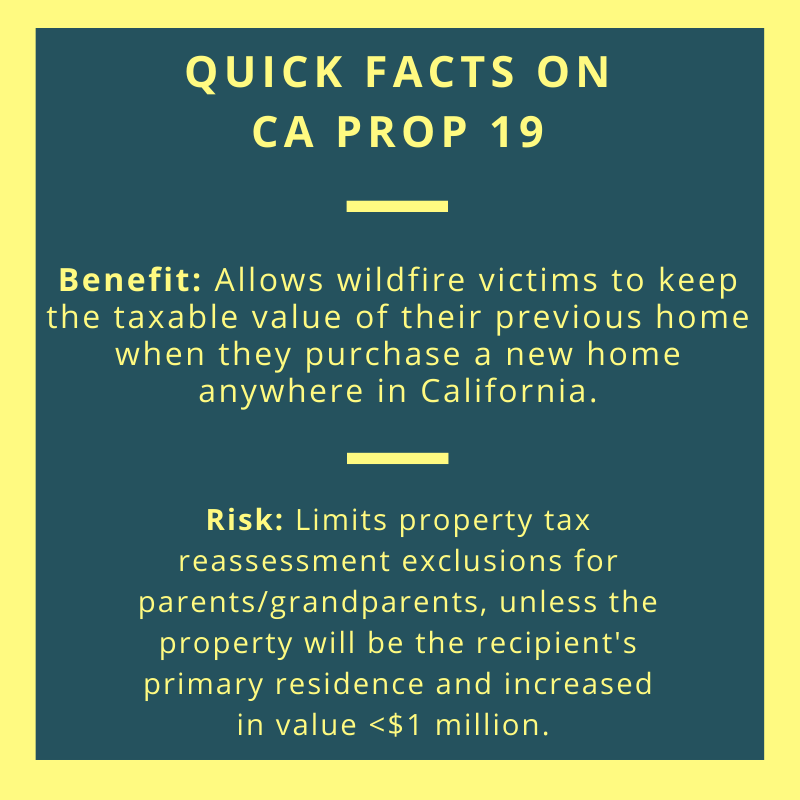

19 although it has already been implemented. 19 Radically Altered Prop. Keep the receipts for your home improvements.

A full chart of federal estate tax rates is below. To make sure you dont run into any trouble with the IRS here are ten tips to help you avoid capital gains tax when selling your property in California. Transfer between husbands and wives are exempt from reassessment.

Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live. For estates that exceed this amount the top tax rate is 40. Giving a Retirement Account Retirement accounts can be tricky inheritances for your beneficiaries.

Payment and receipt of income. The property tax situation in California has again been dramatically altered by the passage of the landmark California tax Proposition 19 in November 2020 which went into effect Feb. What Are the Legal Options to Avoid Estate Tax in California.

Ad Financial privacy flexibility and asset protection. Protect your financial privacy. Expert asset protection since 1906.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. 1 Sale occurs 2 years after purchase 2 House must be used as the main home for 2 out of the 5 years prior to sale and 3 Not excluded under 250k500k capital gains exemption. The surviving tenant will need to sign an Affidavit of Cotenant Residency.

No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. The estate tax is paid out of the estate so the beneficiaries will not be liable for paying the estate tax technically speakingalthough it would deplete the amount left in the estate for distribution. The exemption for 1000000 of other property is no longer effective.

Blessed is the hand that gives indeed. One way to get around the estate tax is to hand off portions of your wealth to your family members through gifts. Thats because with limited exceptionsand barring aggressive countermeasuresCalifornia Prop 19 eliminates a.

Preparation of tax returns. Give gifts to family. 2 How to Avoid Inheritance Tax and Capital Gains Tax in California 21 Sell the property as fast as you can 22 Make the property your primary residence 23 Defer your taxes as an investment property 24 Disclaim the inheritance altogether 3 Get Your Inherited Property Taken Care Of.

The two years dont need to be consecutive but house-flippers should beware. Regardless of the size of the estate the Franchise Tax Board think the IRS for the state of California will not levy any estate taxes on the inheritance. How do I avoid capital gains tax on real estate in California.

This clause in the tax law allows. For this method to work upon purchase of the property you must transfer the property immediately into a legal entity. To avoid reassessment the two cotenants must have owned 100 of the property for one year prior to the death the property must have been the principal residence for both for one year prior to death and the survivor must keep 100.

A trust is essentially a financial arrangement between three parties. Below we review a number of different ways you can avoid the estate tax if you expect your estate to owe. The California Capital Gains Tax is due to both federal the IRS and state tax agencies the Franchise Tax Board or FTB so its common to feel like one is being double-taxed in the process of a home sale.

How to Avoid Capital Gains Tax on Real Estate. Putting assets into a trust before death can reduce the taxable estate and help avoid estate taxes. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Interspousal Transfers RT Code 63. Avoiding Probate in California Estate. The following factors are helpful in planning to establish nonresident status in California.

The Legal Entity Exclusion Revenue and Taxation RT Code Section 64 a c and d One method of avoiding reassessment is to hold the property in a legal entity such as a limited-liability company LLC or corporation.

Is Inheritance Taxable In California California Trust Estate Probate Litigation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

5 Ways The Rich Can Avoid The Estate Tax Smartasset

California Estate Tax Everything You Need To Know Smartasset

California Gift Taxes Explained Snyder Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Estate Tax Everything You Need To Know Smartasset

How To Avoid Estate Tax For Ultra High Net Worth Family

California Gift Tax All You Need To Know Smartasset

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

To A B Or Not To A B That Is The Question Botti Morison

How To Avoid Estate Tax For Ultra High Net Worth Family

Distributable Net Income Tax Rules For Bypass Trusts

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt

California Estate Tax Everything You Need To Know Smartasset